Key takeaways

- Financial services contact centers must balance speed, compliance, and security to retain increasingly demanding customers.

- Agent attrition and poor training directly impact customer satisfaction, operational costs, and regulatory risk.

- Scalable staffing and flexible scheduling help financial contact centers handle peaks without sacrificing service quality.

- Omnichannel support improves customer engagement, personalization, and resolution speed for complex financial interactions.

- Qualified, well-trained agents reduce fraud risk while delivering compliant, high-quality customer experiences.

It’s estimated that the financial services sector accounts for nearly 25% of the world’s economy.

With so much at stake, contact centers must be managed and optimized to provide the best — and most compliant — customer service.

Whether your agents are juggling mortgage inquiries, account issues or simple banking questions, read on for actionable insights you can use to make sure your contact center is optimized for success.

Top Challenges for Financial Services Contact Centers

Financial services companies share some common concerns with other industries, like agent attrition. But this vertical also has its distinct challenges, including fierce competition and complex compliance regulations.

Poor Customer Satisfaction

When you call your bank, you expect excellent service, 24/7 availability and perfect data security.

Because when you’re locked out of your checking account or need to report suspicious activity, you want to get a hold of someone. Fast.

Competition in the finance world is fierce. Top companies know what’s at stake if they fail to optimize their contact centers for speed, security and expertise.

Put yourself in your customers’ shoes. You’d probably consider switching to another institution if your expectations aren't consistently met. Right?

You’re not alone. Unfortunately, banks are losing the customer satisfaction race.

In the first quarter of 2024, 32% of people stated they’d like to switch banks as soon as possible. That’s an 18% increase from the first half of 2019.

Agent Attrition

High agent attrition disrupts planning and budgets. Agents leave for many reasons, but the main culprits are poor training, heavy workloads, repetitive tasks and outdated technology.

The last thing you want is to train an agent to handle complex tasks like loan underwriting or interest rate risk management — only to have them jump to a competitor because they feel undervalued.

Regulatory Compliance

The regulatory environment for finance contact centers is complex. Agents need to understand and follow an alphabet soup of compliance regulations like GLBA, TCPA and PCI DSS to protect sensitive customer information.

Without the right tools, staying compliant is difficult and costly.

Seven Strategies Finance Companies Use to Solve Contact Center Challenges

If you run a financial services contact center, you already know the “low-hanging fruit” ways of enhancing the customer experience and increasing profits.

These include implementing effective self-service options and using streamlined call routing to reduce hold times.

But the top finance companies know that strengthening their frontline teams has the biggest impact.

Proper training, scheduling options and agent incentives significantly improve customer satisfaction and reduce attrition rates. Empowering agents also helps boost compliance and reduce fraud.

Finally, meeting customers on the channels where they need you most creates the brand loyalty you need to keep customers from taking their business (and their money) elsewhere.

Provide Robust Training and Support

Top financial services companies use tools like online courses, coaching and simulation exercises to empower agents with the knowledge and confidence to provide the best customer service possible.

These tools help agents follow compliance rules and prepare them to handle any type of call, from everyday banking issues like bounced checks to sensitive matters like defaulted mortgages.

Prioritize Fraud Mitigation

Fraudsters target busy contact centers — and the finance industry is the most common prey.

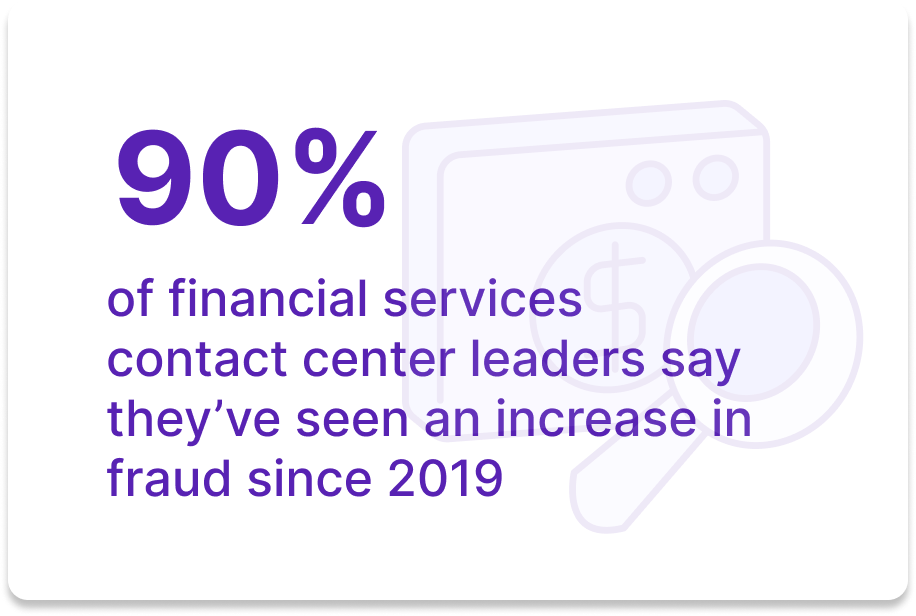

Approximately 90% of contact centers in this vertical report seeing a noticeable increase in fraud since 2021. One in five say attacks are up more than 80%. And the majority report that most account takeovers start in the contact center.

You can significantly reduce the risk of fraud by investing in staff awareness and training. Implementing better caller authentication and customer verification processes is also effective.

Consider Future Staffing Needs

Estimating the number of agents needed to handle peak call volumes while maintaining service quality standards is challenging.

(That’s an understatement.)

But the most successful finance contact center leaders know that when a customer calls to close on a loan, the last thing they want is a long hold time or an overwhelmed agent making a mistake.

It’s important to embrace a scalable staffing model that lets your team quickly respond to changes in customer demand.

Optimize the Scheduling Process

Another staffing challenge is creating efficient schedules that strike a balance between your operational needs — and your agents’ stress levels.

Flexible schedules and automated scheduling can lead to higher focus and motivation in agents. This reduces attrition and the risk of costly errors.

Offer Remote Work Options

Like all industries, the financial services sector had to pivot to remote work during the pandemic.

It was the beginning of a cultural shift. The majority of workers today still want the option to work remotely. The contact centers that provide it have their pick of the most skilled agents.

Consider Alternative Resources

Outsourcing, overflow routing and self-service options are great tools for supplementing your staff.

Chatbots can handle basic interactions and allow agents to focus on more demanding interactions during peak hours.

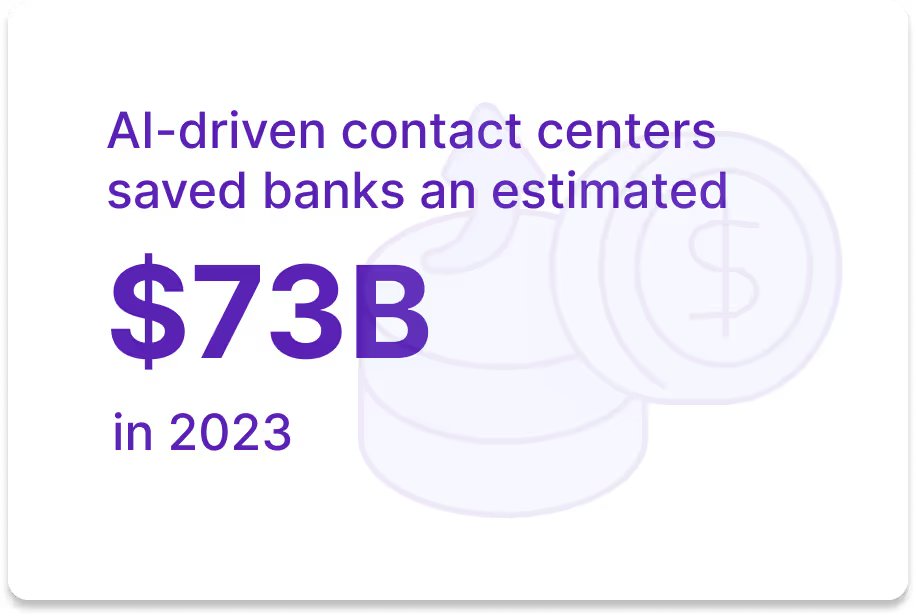

Banks alone saved an estimated $7.3 billion using chatbots to reduce customer service costs in 2023. That’s four minutes per query — almost half a million human working years.

Embrace Omnichannel Solutions

For modern financial services companies, an omnichannel approach has many benefits. After all, a seamless customer experience is especially important when money or property is at stake.

There are many advantages to using omnichannel solutions.

Better Customer Engagement

When customers can keep a conversation going between their banking app and the chatbox on their desktop without losing context, they have a better experience with less frustration.

Efficient Closed-Loop Systems

Omnichannel solutions give agents a more holistic view of customer data and interaction history.

This makes personalization easier and speeds up the resolution process — which is vital for complex financial issues.

Consistent Brand Experience

Consistency across all customer touchpoints is crucial for a strong finance brand.

Whether your customers engage on social media, over the phone or in the app, omnichannel solutions let you build a uniform experience that reinforces loyalty and trust.

Data-Driven Insights

Omnichannel contact centers offer more nuanced insight into customer preferences and behaviors. This data can help further tailor interactions and improve services along with overall customer satisfaction.

How ShyftOff is Helping Finance Companies Optimize Contact Center Management

At ShyftOff, we understand that running a contact center comes with many challenges — especially in the financial services industry.

That’s why we make sure all of our agents are highly qualified to meet the complex demands of modern finance contact centers.

ShyftOff can help you stay compliant — without the headaches.

We use AI to screen our database for the talent you need to succeed. All of our agents are U.S.-based and have the skills and expertise necessary to follow and stay up-to-date on complex regulations.

We also handle all the training and provide flexible scheduling and competitive pay. This incentivizes our agents to provide the highest quality of support to your customers — while minimizing the risk that agents jump ship to your competition.

ShyftOff agents are passionate about delivering exceptional customer experiences so you can meet (and even exceed) your KPI and ROI targets.

Book a demo today to learn how ShyftOff can benefit your company — while saving 35% on your contact center operations.

Frequently Asked Questions

What are the biggest challenges facing financial services contact centers?

Financial services contact centers face poor customer satisfaction, high agent attrition, and complex regulatory compliance requirements including GLBA, TCPA, and PCI DSS.

How can financial services companies reduce fraud in their contact centers?

Approximately 90% of financial services contact centers report increased fraud since 2021. Companies can reduce fraud risk by investing in staff awareness training, implementing stronger caller authentication processes, and deploying better customer verification procedures.

Why is agent training important for financial services contact centers?

Robust training through online courses, coaching, and simulation exercises empowers agents to handle compliance requirements and diverse call types—from everyday banking issues to sensitive matters like defaulted mortgages.

What are the benefits of omnichannel solutions for financial services?

Omnichannel solutions provide better customer engagement, efficient closed-loop systems with holistic customer data views, consistent brand experiences across all touchpoints, and data-driven insights into customer preferences and behaviors.

How can flexible scheduling improve contact center performance?

Flexible schedules and automated scheduling lead to higher focus and motivation in agents, which reduces attrition and the risk of costly errors.

Why should financial services contact centers offer remote work options?

Contact centers that provide remote work options have their pick of the most skilled agents, as the majority of workers today still want the option to work remotely.

How can AI and chatbots help financial services contact centers?

Chatbots can handle basic interactions and allow agents to focus on more demanding interactions during peak hours. Banks alone saved an estimated $7.3 billion using chatbots to reduce customer service costs in 2023.

How does ShyftOff help financial services companies optimize their contact centers?

ShyftOff provides highly qualified U.S.-based agents trained to meet complex demands and stay compliant with regulations, handles all training, offers flexible scheduling and competitive pay, and helps companies save 35% on contact center operations.

%2520(1)%2520(1).avif)

.avif)

.avif)

.avif)

.avif)

.avif)

%2520(2).avif)

.avif)